How to Determine the Right Allocation Percentages for Your Investment Portfolio

Determining the right investment portfolio allocation percentages is one of the most important decisions an investor can make. Asset allocation, how much you invest in stocks, bonds, cash, and alternative investments, has a far greater impact on long-term results than picking individual securities. For business owners and high earners, getting allocation right helps manage risk, smooth returns, and align investments with real-world goals like retirement, liquidity, and tax efficiency.

Below is a practical framework for deciding how your portfolio should be allocated.

What Is Asset Allocation and Why It Matters

Asset allocation is the process of dividing your portfolio among different asset classes such as equities, fixed income, cash, and alternatives. Each asset class behaves differently over time. Stocks tend to offer higher long-term growth with more volatility, while bonds and cash provide stability and income but lower expected returns.

The right allocation balances growth and protection so your portfolio can compound while still allowing you to stay invested during inevitable market downturns.

Step 1: Clarify the Purpose of the Money

Before choosing percentages, you must define what the money is for. A portfolio designed to fund retirement in 25 years should look very different from one meant to support spending in the next three years.

Ask yourself:

When will I need this money?

Will I be adding to it regularly or drawing from it?

How flexible is the goal if markets are volatile?

Time horizon is the single biggest driver of allocation decisions.

Step 2: Understand Risk Tolerance vs. Risk Capacity

Risk tolerance is emotional—how much volatility you can stomach without making poor decisions. Risk capacity is mathematical—how much risk you can take without jeopardizing your goals.

Many investors overestimate their tolerance until markets decline. The correct allocation is one you can stick with through good markets and bad. A slightly more conservative portfolio that you hold consistently often outperforms an aggressive one you abandon at the wrong time.

Step 3: Consider Your Human Capital and Cash Flow

For business owners, your income and business equity already create concentration risk. If your income depends on economic growth, your investment portfolio may need to be more diversified and less aggressive than someone with a stable salary.

Consistent cash flow can also allow for higher equity exposure since you’re regularly investing and not relying on the portfolio for near-term spending.

Step 4: Build the Core Allocation

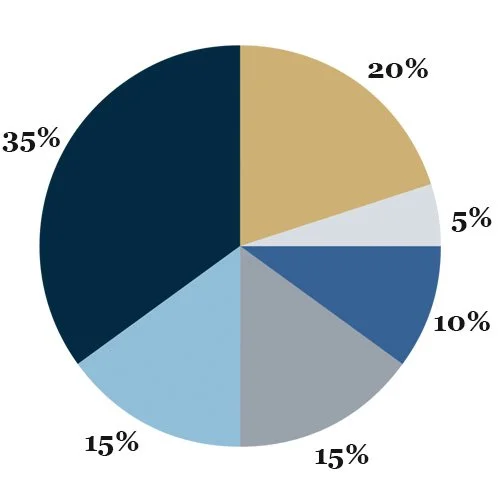

While there is no one-size-fits-all formula, most long-term portfolios are built around three core components:

Equities (Stocks): Growth engine of the portfolio

Fixed Income (Bonds): Stability, income, and downside protection

Cash and Short-Term Assets: Liquidity and flexibility

Younger or long-horizon investors often tilt more heavily toward equities. As time horizons shorten or spending needs increase, portfolios typically shift toward bonds and cash.

Step 5: Factor in Taxes and Account Location

Allocation decisions shouldn’t ignore taxes. Asset placement—deciding which investments go in taxable accounts versus retirement accounts—can materially improve after-tax returns.

For example:

Tax-inefficient assets may belong in tax-deferred accounts

Long-term growth assets may be better suited for taxable accounts

This is especially important for high-income business owners navigating complex tax situations.

Step 6: Rebalance and Adjust Over Time

Your allocation is not a “set it and forget it” decision. Market movements will cause drift, and life changes may require adjustments.

Regular rebalancing:

Controls risk

Forces disciplined buy-low, sell-high behavior

Keeps the portfolio aligned with your goals

Revisiting allocation annually—or after major life events—is a best practice.

Common Allocation Mistakes to Avoid

Chasing recent performance

Overreacting to short-term market news

Ignoring cash needs

Treating all money as if it has the same purpose

Successful portfolios are built intentionally, not emotionally.

Final Thoughts

Determining the right investment portfolio allocation percentages is about aligning money with purpose, risk, and time—not predicting markets. When done correctly, allocation provides clarity, confidence, and consistency, allowing investors to stay focused on what truly matters.

At Cool Wealth Management, we help Phoenix-area investors and business owners design portfolios that fit their lives, not just market assumptions. The goal isn’t to be aggressive or conservative—it’s to be intentional.