Articles

How Perfectionism Is Holding Your Business Back

Perfectionism can silently destroy progress in business. Many entrepreneurs in Phoenix and across the country get stuck chasing flawless marketing campaigns, products, or presentations. While striving for quality is important, perfectionism turns actionable ideas into endless drafts, delaying launches, slowing growth, and draining motivation. At Cool Wealth Management, we see how this mindset can affect decision-making, financial planning, and overall business efficiency. Business owners who prioritize perfection over progress often miss opportunities to learn, adapt, and scale. Recognizing this pattern is the first step toward sustainable success.

Maximizing Cash Flow for Business Owners: Strategies to Keep Your Business Healthy

As a business owner in Phoenix, Arizona, managing cash flow is critical to keeping your company healthy and growing. Cash flow is the lifeblood of any business — it determines your ability to pay employees, invest in opportunities, and weather unexpected challenges. Business owners often struggle with balancing expenses and revenue, but there are proven strategies to optimize cash flow, improve liquidity, and ensure your business thrives year-round. By understanding your cash flow cycles, leveraging financial planning tools, and strategically managing expenses, you can maintain a stronger financial position for your business.

When to Consider Debt as a Tool for Your Financial Strategy

Debt often carries a negative connotation, but when used strategically, it can be a powerful tool for business owners and investors. At Cool Wealth Management in Phoenix, Arizona, we help clients understand when taking on debt can make sense to accelerate growth, improve cash flow, or increase long-term wealth. Knowing the difference between productive and harmful debt is critical for maximizing opportunities while minimizing financial risk.

How to Enjoy Vacation Without Breaking Your Budget

Vacations are meant to be relaxing, fun, and memorable—but overspending can quickly turn a dream getaway into a financial headache. At Cool Wealth Management in Phoenix, Arizona, we help clients understand how to enjoy life while staying on track financially. Knowing how much to spend on vacation requires planning, understanding your travel priorities, and balancing experiences with your budget. By setting clear limits for accommodation, meals, activities, and souvenirs, you can enjoy your trip without worrying about overspending or affecting your long-term financial goals.

When Disability Insurance Makes Sense (And When It Doesn’t)

When it comes to financial planning in Phoenix, Arizona, one question we hear often is whether disability insurance makes sense. Disability insurance is designed to replace income if you’re unable to work due to illness or injury, making it an important consideration for business owners, high earners, and families relying on one income. Still, not everyone needs it, and in some cases, the costs outweigh the benefits. At Cool Wealth Management, we help clients decide when disability insurance strengthens their financial plan and when other strategies are a better fit.

3 Effective Ways to Save on Taxes During Estate Planning

Estate planning is a critical step for anyone looking to protect their wealth and pass it on efficiently. At Cool Wealth Management in Phoenix, Arizona, we help business owners and high-net-worth individuals design strategies to minimize taxes while ensuring their assets go where they want. With the right planning, you can reduce estate taxes, gift taxes, and income taxes for your heirs. Here are three practical ways to save on taxes during estate planning.

The Psychology of Money vs. What Makes Sense on Paper

When it comes to building wealth, there’s a clear difference between the psychology of money and what makes sense on paper. Many people in Phoenix and beyond struggle because their emotions around money—fear, guilt, or greed—override rational financial decisions. On paper, investing early, diversifying assets, and sticking to a long-term plan is logical. But psychologically, watching the market drop or comparing yourself to peers can make you make choices that feel safer or more rewarding in the moment, even if they’re costly in the long run.

How to Handle Money from Short-Term Careers Like Athletics

Short-term careers, like athletics, entertainment, or high-intensity contract roles, offer the potential for high earnings—but often only for a limited period. Athletes, in particular, face unique financial challenges: sudden wealth, a relatively short earning window, and the pressure to maintain a lifestyle long after their careers end. Managing money from a short-term career requires careful planning, disciplined saving, and smart investment strategies to ensure long-term financial security.

The Psychology Behind Owning Metals

For many investors, owning metals like gold and silver goes beyond financial strategy—it taps into deep psychological motivations. Investors in Phoenix and across the U.S. often turn to precious metals as a hedge against uncertainty, inflation, and market volatility. The emotional comfort of holding a tangible asset can influence investment decisions as much as market fundamentals. Understanding the psychology behind owning metals helps investors make informed decisions and integrate them effectively into a diversified wealth management strategy.

Maximizing Your Tax Savings with Advertising Write-Offs

For small business owners in Phoenix and across the U.S., advertising write-offs are a powerful tool to reduce taxable income. Understanding which advertising expenses are deductible can help your business save money while effectively promoting your services. From online marketing and social media ads to print materials and event sponsorships, eligible advertising expenses can significantly lower your annual tax bill when properly documented. At Cool Wealth Management, we help business owners identify every possible deduction, including advertising write-offs, so they can keep more of their hard-earned revenue.

How to Avoid Probate Court and Protect Your Assets

Probate court can be time-consuming, costly, and stressful for your loved ones. Fortunately, there are effective ways to avoid probate in Arizona and ensure your assets are distributed according to your wishes. By planning ahead, you can protect your estate, minimize fees, and simplify the transfer process for your heirs. Understanding probate avoidance strategies is an essential step for anyone looking to safeguard their wealth and create a smooth legacy for their family.

Does Giving Your Kids Too Much Inheritance Spoil Them?

When it comes to inheritance planning, many parents wonder: does giving your kids too much inheritance spoil them? At Cool Wealth Management in Phoenix, Arizona, we work with business owners and high-net-worth families to design financial strategies that preserve wealth without creating dependency. Passing down money is important, but without proper guidance, large inheritances can sometimes encourage poor financial habits or a lack of personal responsibility. Understanding how to balance generosity with financial education is key to ensuring your children are empowered, not entitled.

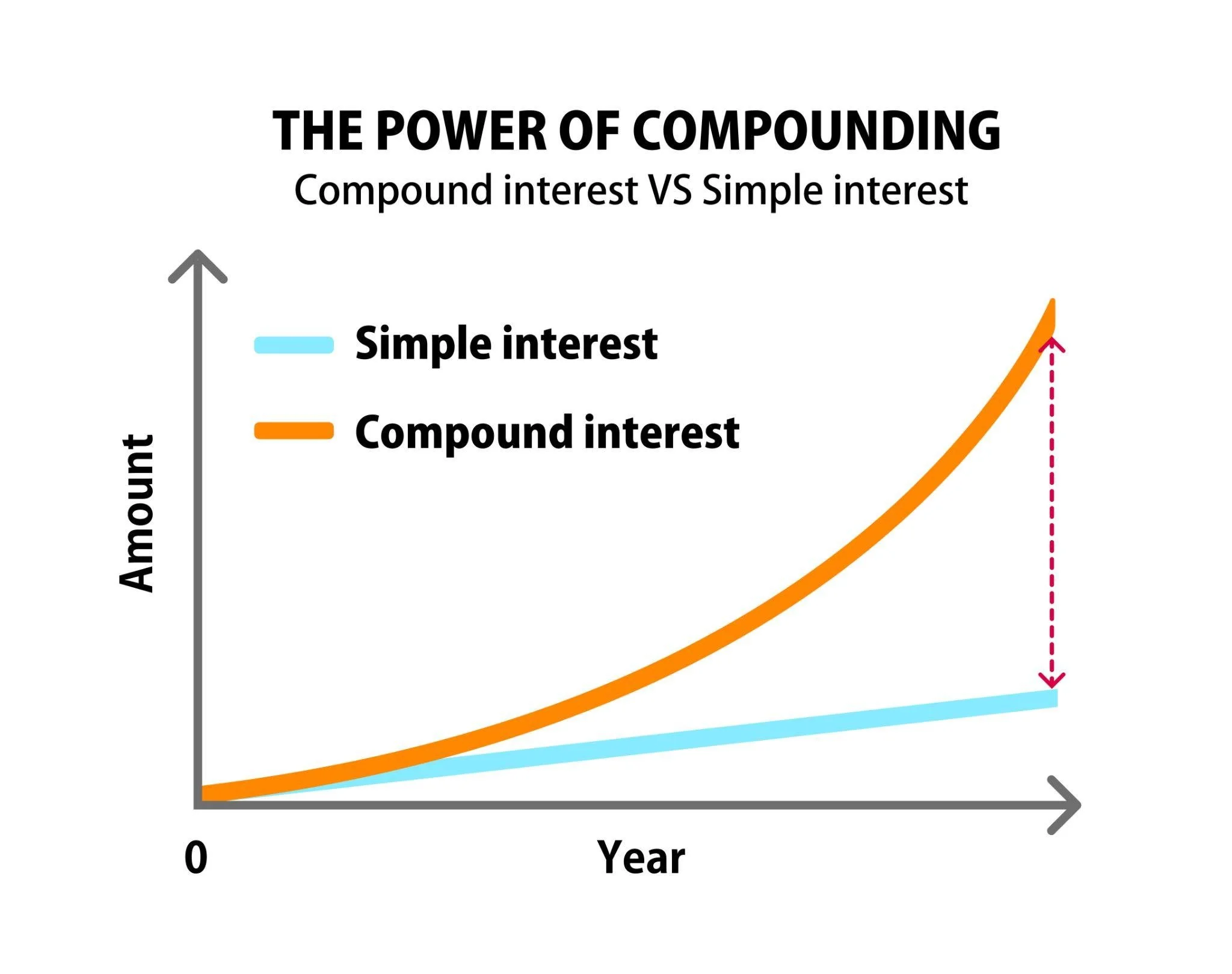

The Power of Compounding: Building Wealth Over Time

At Cool Wealth Management in Phoenix, Arizona, we believe the single most important principle for long-term financial success is the power of compounding. Whether you’re saving for retirement, investing for your business, or building a legacy for your family, compounding turns small, consistent contributions into significant wealth. By reinvesting earnings and allowing growth to build upon itself, your money works harder the longer it stays invested. For business owners and families alike, understanding this concept is crucial to creating lasting financial security and maximizing tax-efficient strategies.

Cross-Border Estate Planning: Navigating International Inheritance for a Secure Legacy

In today's interconnected world, cross-border estate planning has become essential for individuals with international assets, expatriates, and families spanning multiple countries. At Cool Wealth Management in Phoenix, Arizona, we specialize in comprehensive financial advising that includes tailored strategies for global estate planning. Whether you're dealing with foreign property, overseas investments, or dual citizenship, understanding cross-border inheritance laws, international tax implications, and asset protection is crucial to avoid costly pitfalls. Our expert team helps clients minimize estate taxes, ensure smooth wealth transfer, and comply with varying jurisdictions, safeguarding your legacy for future generations.

How Business Structure Shapes Your Exit Strategy

When it comes to exit planning for business owners in Phoenix and beyond, your business structure is one of the most important factors to consider. Whether you operate as a sole proprietorship, partnership, S corporation, C corporation, or LLC, the structure you choose has direct implications for your tax planning, wealth management, and ultimately, your ability to sell or transition your company successfully. At Cool Wealth Management, we specialize in helping business owners understand how their structure affects both day-to-day operations and long-term exit strategies.

Why Real Estate Works Better at Scale

Real estate works better at scale, especially for investors aiming to grow long-term wealth. Owning a single rental property can provide steady cash flow, but expanding to multiple properties amplifies returns, spreads risk, and opens opportunities for better financing. At Cool Wealth Management in Phoenix, Arizona, we help clients understand how scaling real estate investments can create efficiency, increase cash flow, and build equity faster. Managing multiple properties allows for cost savings through economies of scale, professional management, and strategic planning, making your real estate portfolio more profitable and resilient.

Most Millionaires Are Ordinary People, Here’s How Good Habits Made Them Wealthy

Most millionaires are regular people who didn’t inherit wealth or hit the lottery. Instead, they built financial security through consistent habits and smart decisions. Simple practices like budgeting, saving, investing early, and living below their means add up over time. At Cool Wealth Management in Phoenix, Arizona, we help clients adopt these habits and create strategies that grow their wealth steadily. Being disciplined with money, avoiding lifestyle inflation, and making informed investment choices are what separate long-term wealth builders from those who struggle financially.

When Will Investing Start to Pay Off? A Realistic Guide for Building Wealth

If you’re investing your money, you probably want to know: when will it start to feel like it’s paying off? At Cool Wealth Management in Phoenix, Arizona, we help clients understand that investing is a long-term game. Many people expect quick results, but the reality is that seeing meaningful returns depends on several factors, including your investment strategy, risk tolerance, and time horizon. Understanding what to expect can help you stay committed and avoid making impulsive decisions.

Risk Tolerance vs. Risk Capacity: What Phoenix Investors Need to Know

At Cool Wealth Management in Phoenix, Arizona, we often meet investors who know they should “take some risk” but aren’t sure exactly how much. The truth is, smart investing isn’t just about picking the right assets—it’s about balancing your risk tolerance (how you feel about risk) with your risk capacity (how much risk your finances can actually handle). Understanding both concepts is critical for building a portfolio that aligns with your goals, avoids unnecessary stress, and keeps you on track through market ups and downs.

Live the Life You Want Without Sacrificing Your Purpose

Living the life you want doesn’t mean sacrificing your purpose. At Cool Wealth Management in Phoenix, Arizona, we help business owners and high-earning professionals design a financial plan that aligns with their values, goals, and passions. True wealth isn’t just about money—it’s about the freedom to spend your time intentionally, pursue meaningful work, and create experiences that matter. By integrating smart investing, tax efficiency, and long-term planning, you can live fully today while securing your future.